Buy Now, Pay Later FAQ: Affirm Financing - Remote Control Hobbies

BUY NOW, PAY LATER FAQ: AFFIRM FINANCING - REMOTE CONTROL HOBBIES

BUY NOW, PAY LATER WITH

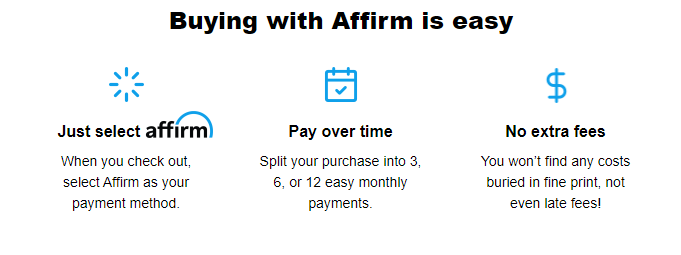

We have teamed up with Affirm to offer easy financing without any hidden fees. No gimmicks like deferred interest or hidden fees, so the total you see at checkout is always what you actually pay.

"Rates from 0-36% APR based on credit, and is subject to an eligibility check. For example, a $700 purchase might cost $63.18/mo over 12 months at 15% APR.

Payment options through Affirm are subject to an eligibility check, may not be available in all states, and are provided by these lending partners: affirm.com/lenders.

Options depend on your purchase amount, and a down payment may be required. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Finance Lenders Law license. For licenses and disclosures, see affirm.com/licenses."

FAQs

Q: Does Affirm perform a credit check?

A: Yes, when you first create an Affirm account, they perform a ‘soft’ credit check to help verify your identity and determine your eligibility for financing. This ‘soft’ credit check will not affect your credit score. If you apply for more loans with Affirm, they may perform additional ‘soft’ credit checks to ensure that they offer you the best financing options possible. You may not always qualify for the full amount of your purchase. When this happens,

Q: Why was I prompted to pay a down payment with a debit card?

A: You may not always qualify for the full amount of your purchase. When this happens, Affirm will ask you to make a down payment and process this payment right after you confirm your loan. After that, it’s business as usual. Your first payment is due at the usual time, you can review your payment schedule in your account.

Q: Why was I prompted for a checking account?

A: As part of your loan request, Affirm may ask you to link an active checking account to help verify your ability to repay the loan. Linking your account allows Affirm to view your account only; it doesn't enable them to debit your account. To link your account, Affirm uses a secure service that encrypts your online banking login information, which means they don't store your login information and can't even see it.

For more information visit: https://www.affirm.com/help/

HOW DOES IT WORK?

-

Add to Cart -

with Affirm -

Receive your items -

Pay over time

FAQS

DOES AFFIRM PERFORM A CREDIT CHECK?

Yes, when you first create an Affirm account, they perform a ‘soft’ credit check to help verify your identity and determine your eligibility for financing. This ‘soft’ credit check will not affect your credit score. If you apply for more loans with Affirm, they may perform additional ‘soft’ credit checks to ensure that they offer you the best financing options possible.

WHY WAS I PROMPTED TO PAY A DOWN PAYMENT WITH A DEBIT CARD?

Affirm tries hard to approve every purchase but sometimes can’t approve the full amount. When this happens, they provide a debit card down payment option so that you may still complete your purchase right away.

WHY WAS I PROMPTED FOR A CHECKING ACCOUNT?

Affirm sometimes requires additional information to consider a credit application. Such information may include an active checking account, which helps them verify your identity and your ability to repay the requested loan. If Affirm prompts you for this information but you are unable to provide it, Affirm will be unable to approve your credit application.

WHAT HAPPENS IF I CANCEL MY ORDER?

If you cancel your order, we will issue you a store credit. The store credit is valid for 30 days. At no time will we issue you a "cash" refund

For more information visit: https://www.affirm.com/faqs/